By Sami Zaptia.

London, 17 May 2017:

The General Electricity Company of Libya (GECOL) revealed that it will have investment projects in its sector in the billions of dollars between now and 2030. Besides unimplemented existing contracts, these will include the fast tracking of power turbines in order to resolve Libya’s current acute power generation deficit. The projects will also include substations and transmission lines.

These revelations came during GECOL’s presentation at the Libya Investment Summit in Istanbul held between 9-11 May.

GECOL reported that it has 13 main power stations, most of which are located on the coast. Five of these are gas powered, five are powered by steam and three use a combined cycle. Libya’s peak load consumption is growing at an average of 5.8 percent per year while generation capacity is growing at an average of only 5.4 percent per year, GECOL explained. Half of the turbines currently operating in Libya’s power stations are supplied by US giant General Electric.

Its transmission grid runs for about 2,000 km east to west from the Tunisian border to the Egyptian border and runs for about 900 km south delivering power to 99 percent of the country.

Due to the abnormal circumstances that the country is going through since the 2011 revolution, Libya’s national grid faced a generation deficit leading to 2,650 MW of load sharing (organized power cuts rotated on different areas). This represents 37 percent of total peak load, GECOL explained. There were also a number of total black outs during 2016-17 admitted GECOL.

To address this power generation deficit, GECOL reported that it had negotiated with its existing contractors to resume their work at their project worksites. The total generation capacity under construction is 4,083 MW over seven locations. The largest of these are the Tripoli West-2 projected planned to generate 1,400 MW and the Gulf of Sirte power station planned to generate 1,050 MW. These are a mixture of steam, gas and mixed turbine power stations.

| Under construction power plant location | Capacity MW | |

| 1 | Zahra | 141 |

| 2 | Tripoli South | 94 |

| 3 | Tripoli West-2 | 1,400 |

| 4 | Khoms-2 | 524 |

| 5 | Ubari | 624 |

| 6 | Gulf of Sirte | 1,050 |

| 7 | Zueitina | 250 |

| Total: | 4,083 |

Source: GECOL May 2017

Meanwhile, GECOL is planning to fast track four power station projects with a total capacity of 2,500 MW in four different locations and using different combinations of gas, steam and mixed cycle powered turbines.

| Fast track construction power plants / locations | Capacity MW | |

| 1 | Tripoli West | 600 |

| 2 | Tripoli East | 1,400 |

| 3 | Misrata | 600 |

| 4 | Tobruk | 740 |

| Total maximum capacity: | 3,340 | |

| Total fast tracked capacity: | 2,500 |

Source: GECOL May 2017

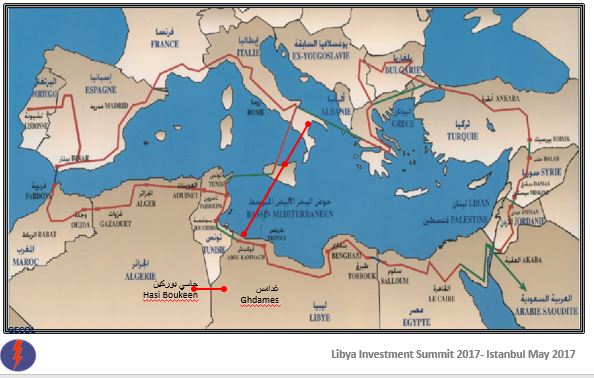

In order to deliver this generated capacity, GECOL has also revealed plans to expand its transmission network of lines and substations. These would eventually link Libya’s network with that of Tunisia, Egypt and Algeria.

GECOL also has a long term plan to link its network to Europe through a submarine cable through Italy in order to export 1,000 MW of power.

Presenting its long term generation capacity needs and projects that would be available for investment, GECOL revealed that it would have need to construct an extra 4,800 MW by 2015, 5075MW by 2020, 3,750 by 2025 and 3,000 MW by 2030. By 2030, these would total a generation capacity of 16,625 MW. These power stations or turbines would be located across the country at different locations and using a combination of gas, steam and combined cycle turbines.

| Planed power generation projects | MW | Contracted? | |

| 1 | 2011-2015 | 4,800 | No |

| 2 | 2016-2020 | 5,075 | No |

| 3 | 2021-2025 | 3,750 | No |

| 4 | 2026-2030 | 3,000 | No |

| Total: | 16,625 |

GECOL were optimistic about the ability of international contractors from Germany, US, Korea and Turkey, etc, to be able to return to their sites and restart their existing projects. They pointed out the deal struck this January with Turkish contractor Enka Teknik which enabled it to restart work on its Obari power station contract.