By Sami Zaptia.

London, 24 April 2017:

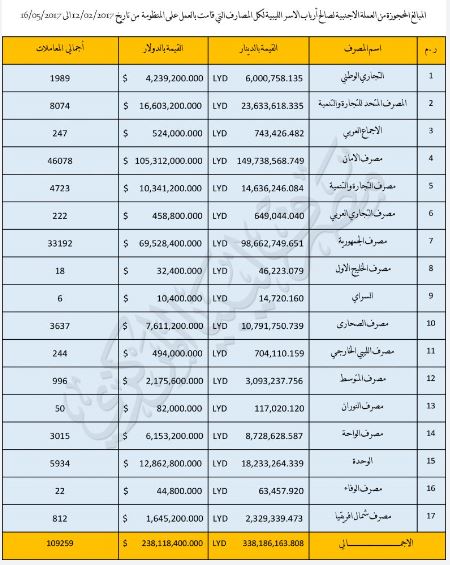

The Central Bank of Libya (CBL) announced today that it has sold more than US$ 238 million at the official exchange rate in the form of US$ 400 per family member – up to 16 May.

The annual allowance was distributed through 17 different commercial banks in a total of 109,259 transactions. Privately owned Aman bank distributed the most amount, US$ 105 million in 46,078 transactions. It was followed by Libya’s largest bank, state-owned Jumhuriya bank with US$ 70 million in 33,192 transactions and privately owned United bank made the third largest distributions of US$ 16 million in 8,074 transactions.

In April, the CBL had reported that it had distributed more than US$ 105 million to 48,169 family heads / transactions through 13 different commercial banks.

The subject of the distribution of hard currency at the official exchange rate is a very sensitive political subject in Libya. The current black market rate is at around LD 8 to the US dollar as opposed to the official rate of LD 1.4 to the dollar – a multiple of nearly 6 times.

The CBL and commercial banks have been accused by the general public of conniving in financial corruption. They stand accused of slowing down the distribution of the dollar allocations and of preferring to distribute the finite hard currency to a smallerbusinessmen and black market traders in return for kickbacks and so forth, rather than distribute them equitably to the public at large.

The CBL’s stock answer to any accusations has been that it is not its job to fight and investigate crime and that it is neither the Public Prosecutor’s Office (PPO) nor the police – who should be investigating any accusations. for its part, it says that it has referred any suspicious transactions or personnel to the PPO.

There are approximately one million families in Libya and a population of over six million. To date the CBL says there have been only 109,259 transactions.