By Sami Zaptia.

Tripoli, 3 July 2014:

The details of the LD 56.96 bn 2014 budget approved on 22 June were released yesterday. The . . .[restrict]budget had been approved by the GNC after the lapse of 90 days meant that it was passed automatically at the GNC sitting on 22 June.

The release of the budget details and its official receipt by the Central Bank of Libya (CBL) prompted a strong reaction from the CBL yesterday in view of the budget’s increasing deficit and its reliance on CBL reserves to fund it.

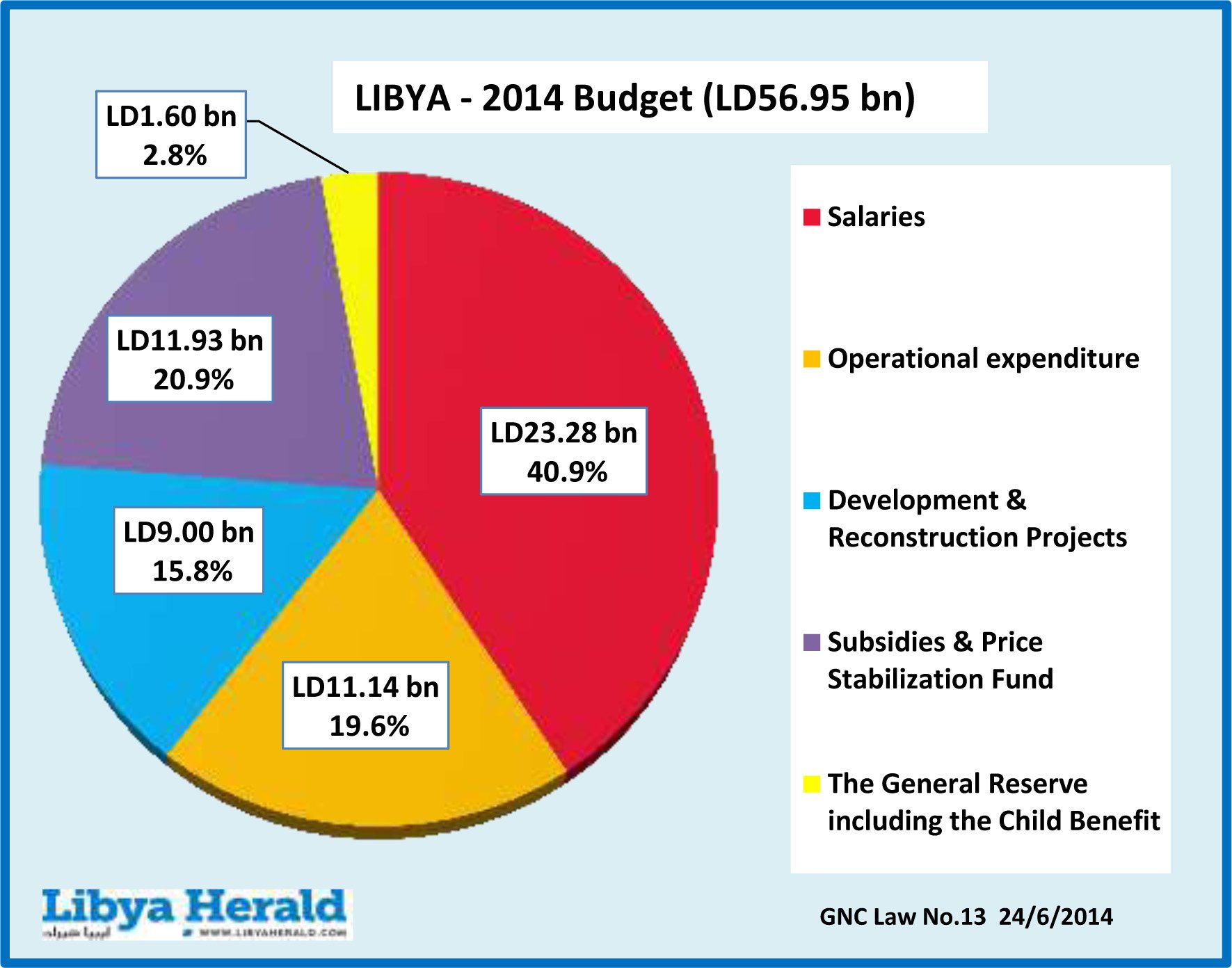

The largest section of Libya’s 2014 budget is chapter 1 covering salaries, which at LD23.27 bn accounts for nearly 41 percent of the total, followed by chapter 4 for subsidies which at LD11.93 bn accounts for 20.9 percent of the budget.

| LD billions |

2013 budget LD |

Percent of total |

2014 budget LD |

Percent of total |

| Chapter (1)- wages | 20.78 | 31.1 | 23.27 | 40.9 |

| Chapter (2)- expenses | 10.77 | 16.1 | 11.14 | 19.6 |

| Chapter (3)- Development | 19.30 | 28.9 | 9.0* | 15.8 |

| Chapter (4)- subsidies | 10.60 | 15.9 | 11.93 | 20.9 |

| Reserves & Contingencies | 5.40 | 8.1 | 1.6 | 2.8 |

| Total: | 66.86 | 100 | 56.95 | 100 |

* LD 2 billion from the 2014 development budget is specified for the newly elected Municipality Councils.

Oil and gas revenues are projected at LD 27.37 bn in the 2014 Budget, of which LD 675 million is set aside to pay public debt, leaving LD 26.7 bn net hydrocarbon revenues to part finance the budget.

The LD 675 million public debt payment is made up of LD 275 million for social security payments and LD 400 million for the Libyan state’s National Commercial Bank debt loan facility used for the Subsidies Fund.

| Revenues for 2014 budget | LD bn |

| Non-hydro-carbon revenues | 6.048 |

| Net hydrocarbon revenues | 26.700 |

| CBL reserves/deposits | 15.998 |

| Carried forward from 2013 budget | 8.205 |

| Total: | 56.95 |

The non-hydrocarbon revenues consist of taxes, customs duties, stamp duties, profits from the state-owned telecoms companies such as Madar and Libyana, CBL profits, revenues from the Subsidies Fund and revenues from local fuel sales.

| Non hydrocarbon revenues | 2014 Budget m |

| Commercial activity taxes | 900.00 |

| Customs duties | 700.00 |

| General stamp duty | 398.16 |

| State telecommunications companies’ profits | 250.00 |

| CBL profits | 2,500.00 |

| Subsidies Fund profits | 300.00 |

| Local fuel sales revenues | 1,000.00 |

| Total: | 6,048.00 |

The subsidies section which totals LD 11.93 bn in the 2014 budget is made up of mainly the LD 7 billion in fuel subsidies. Petrol in Libya is sold at LD 0.15/litre and it is commonly believed that a large amount of this subsidized fuel is smuggled to Libya’s neighbouring countries.

By virtue of article No 24, the 2014 budget commits the government to substitute the goods and fuel subsidies for cash subsidies by 1 January 2015. Article 24 also specifies that this cash subsidy is paid out on the basis of the National ID Number. Article 28 specifies that the National ID Number is used for all budget disbursements, as specified by Law No. (8) of 2014.

The Libyan state is considering a smart card system issued to consumers on the basis of them having a National ID number in the hope of reducing fuel smuggling. The Libyan state is also considering substituting state food subsidies for direct cash payments into the bank accounts of citizens.

The Child Benefit, which is listed under the subsidies section, was introduced recently by the GNC.

| Subsidies | LD billion | |

| 1 | Medicines | 0.700 |

| 2 | Food stuffs | 1.800 |

| 3 | Fuel | 7.000 |

| 4 | Electricity and public lighting | 0.800 |

| 5 | Water and sanitation | 0.400 |

| 6 | Garbage/Public Cleanliness | 0.514 |

| 7 | Animal feed | 0.031 |

| 8 | Fertilizer (urea) | 0.006 |

| 9 | Child benefit 2013 | 0.680 |

| Total: | 11.931 |

Development and projects were allocated only LD 9 bn in 2014, compared to LD 19.3 bn in 2013. This may be unwelcomed news to the hundreds of foreign construction companies and contractors owed money by Libya for stalled projects or new companies wishing to work in Libya.

Although there was little chance of the 2013 allocation being spent on projects due to the security situation, a large amount was nevertheless allocated. Most of this was used on other sections of the budget such as wages by the Ali Zeidan government, as oil revenues collapsed due to the oil ports embargo.

In the 2014 budget, the Libyan state is being more realistic about the possibility of large numbers of projects being implemented especially by foreign contractors, and the budget has been considerably shrunk to only LD 9 bn.

Moreover, with the push for decentralization and with the recent municipality elections, LD 2 bn of this budget will be set aside for local projects.

| Development and projects section 2014 Budget | LD billion | |

| 1 | To be distributed to Municipalities | 2.0 |

| 2 | To be distributed on sectors via Cabinet decision based on Min of Planning suggestion. | 7.0 |

| Total: | 9.0 |

The remaining LD 7 bn allocated for development and projects will be spent by the cabinet based on advice from the Ministry of Planning which is supposed to be the Ministry concerned with listing, assessing and prioritizing all outstanding projects. [/restrict]