By Sami Zaptia.

London, 5 May 2017:

Libya’s National Oil Corporation chairman, Mustafa Sanalla has dismissed claims by international oil experts that Libya will be unable to increase its oil production to its intended target of 800,000 bpd in 2017 or even by 2018.

At a London energy conference in January this year, Sanalla had predicted that oil production could reach 1.25 million bpd by the end of 2017 and 1.6 million bpd by 2022.

Sanalla had also said that NOC-driven projects to expand Libya’s oil production could create ‘‘a virtuous circle of domestic economic stimulus and security’’.

Speaking to Libya Herald from the USA where he has been attending the Offshore Technology Conference in Houston, Sanalla said ‘‘I assure you that we are able to achieve our targets. Pointing out that already ‘‘today’s production is 796,000 barrels per day’’. That is only ‘‘4,000 bpd away from the 800,000 target’’, he stressed in an updated message today.

Explaining why he felt the NOC could achieve its stated target and the factors that are holding the ramping up of production, Sanalla explained that ‘‘What has handicapped us are the closures and the low budgets and their delays’’.

The NOC chairman was referring to various oil port/terminal, oilfield and pipeline closures that have been imposed by a number of usually armed groups as pressure and leverage for one demand or another. Damage was also sustained by oil storage tankers in the various fighting taking place in Libya since 2011.

With regards to his ‘‘low budgets and their delays’’, Sanalla was subtly referring to his displeasure that the Libyan government was not allocating a large enough investment budget for the NOC to enable it to quickly increase production. In the 2017 budget, the NOC was allocated US$ 1.2 bn by the Faiez Serraj Presidency Council/Government of National Accord.

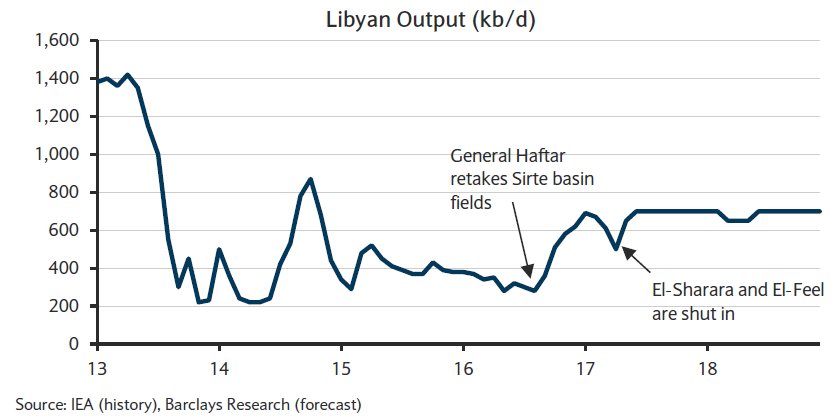

On the claim by the Barclays Research (@Barclays) forecast that the NOC would not be able to achieve its target because of the need for heavy investment and repairs, Sanalla said that that claim was ‘‘totally wrong’’.

‘‘I remind you that many commentators made these same statements in 2011. And they doubted in our ability to even be able to produce’’ oil at all (after a near complete shut-down of Libya’s oil production at the height of Libya’s 2011 Arab Spring Revolution).

‘‘Production reached, thank god and thanks to Libyan efforts, 1.612 million bpd in May 2012. As for the oilfields that have been destroyed or ransacked (Mabrook, Dahra, Ghani, Zinad), their production capacity did not exceed 94,000 bpd’’, he pointed out.

Sanalla then kindly forwarded some of the NOC’s latest data on investment needed to ramp up production. There were two possible options he explained. The lower cost option to steadily maintain and increase production in 2017 would involve a total investment of US$ 550 million.

The second option which would include the replacement of destroyed storage tanks and pipelines would involve a much more substantial investment by the NOC of around US$ 3 billion.

As mentioned earlier, in the 2017 budget, the NOC was allocated US$ 1.2 bn by the current PC/GNA. He had demanded US$ 2.5 billion back in November 2016. For Sanalla, investing in the NOC in order to increase production was a logical no-brainer.

It will be interesting, however, to see if the Libyan government of the day can afford to reward the NOC for its ability to quickly increase production by awarding it a larger investment budget. The Libyan government is operating with a huge budget deficit. Demands – economic, political and at times through armed coercion on its scarce resource – are high. However, hydrocarbon rentier-state Libya has no ‘plan b’ in order to increase state revenues.

Hydrocarbons are the country’s only golden goose, so to speak, and investing in them is the only option. The question is will the political powers that be in Libya make increased NOC investment their top priority in the short term, or will they be happy with a steady and unspectacular increase in oil production with the minimum needed investment.

Equally, in today’s unstable Libya with weak state institutions and security apparatus, there is also the ever-present threat on the horizon of oil production falling back as a result of blockades and fighting.

The writer will be participating in the Libya Investment Summit 2017 on 9-11 May in Istanbul, Turkey and shall be revealing in more detail the total investment needed by the NOC in order to increase Libya’s oil production up to its 2017 and 2018 targets.