By Libya Herald reporter.

Malta, 27 January 2015:

The World Bank has warned in its January MENA Quarterly Economic Brief that the collapse . . .[restrict]in international crude oil prices and Libya’s low oil exports could lead to an increased deficit, eroded foreign currency reserves and lead to a weaker currency.

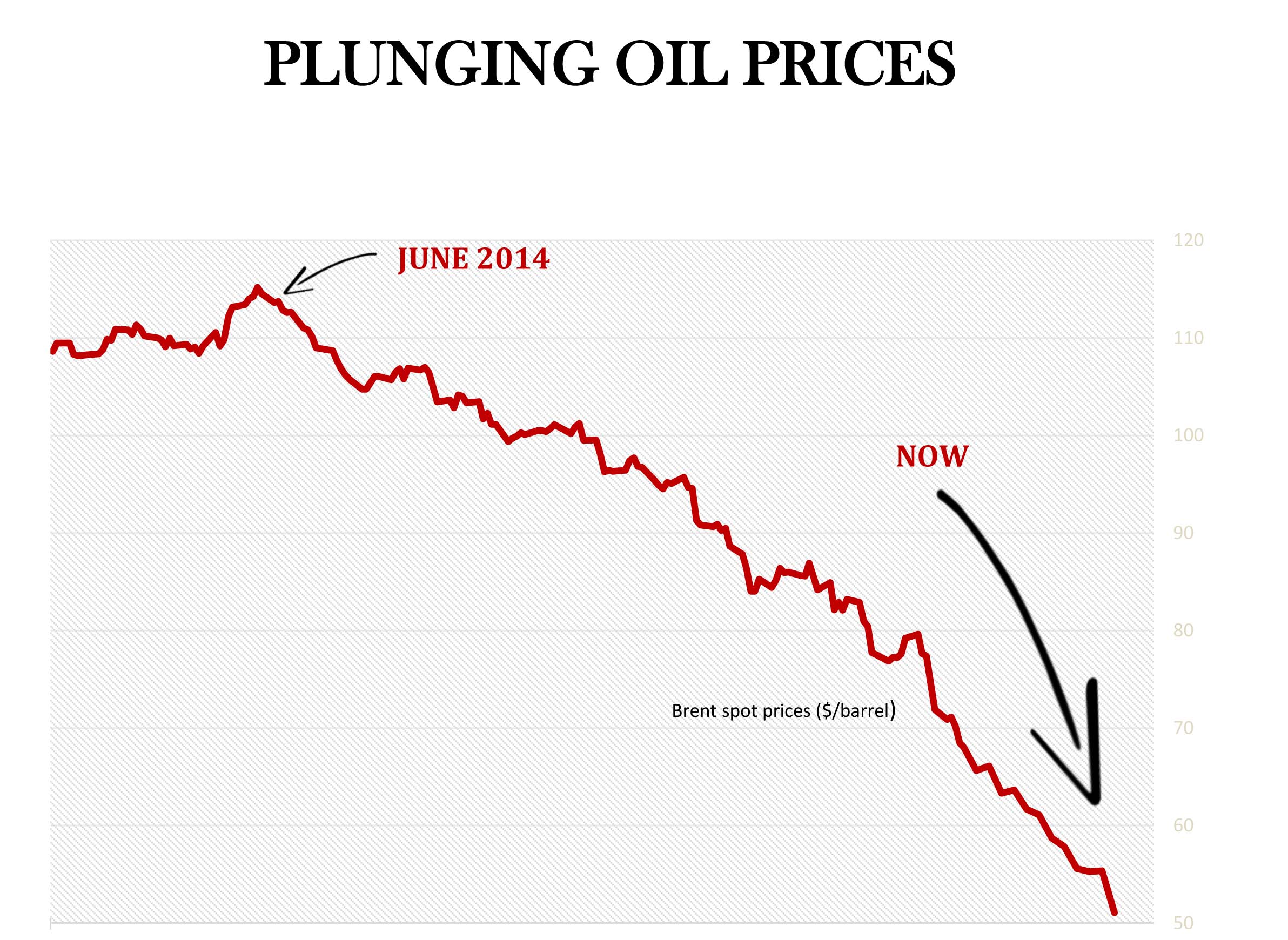

In the report aptly entitled Plunging Oil Prices, the World Bank said that the oil price has ‘’collapsed, reaching a level below $50 per barrel (Brent crude) in early January, a drop of 50 percent since their peak in mid-June 2014’’.

The plunging oil prices will have significant consequences for both oil exporters and importers in the MENA region.

The economies of oil exporters, such as Libya, could be hurt, as oil accounts for more than half their budget revenues and exports earnings in Libya constitutes more than 90 percent of total exports, the report explained.

Fiscal spending, it continued, has been on the rise in these countries and they will likely run larger budget deficits or their surpluses would shrink substantially. Their external accounts would also deteriorate, which could eventually put pressure on their currencies.

On a positive note, however, the report said that falling oil prices will reduce imported inflation in both oil exporters and importers and, depending on the magnitude of the pass-through effects on domestic inflation, could benefit the poor. The slight increase in consumption from lower prices would also contribute to an uptick in growth.

On Libya specifically, the report says that the country ‘’is currently split between rival tribes and political factions with two governments vying for legitimacy since an armed group seized the capital city of Tripoli in August, forcing Prime Minister Abdullah al-Thinni to relocate to the east’’.

‘’Neither side has prepared a budget for 2015. The price of not reaching an agreement is high, as oil production is currently at one-fifth of its pre-crisis 1.6 million b/d. That, combined with falling oil prices have forced the government to dip into its large reserves’’.

‘’Reserves reached $100 billion in August, falling by 20 percent since the start of the year and could be depleted in four years under the current situation’’.

‘’With oil prices plunging and limited oil exports (about 300,000 b/d due to continued fighting and insurgencies in the oil fields), the Libyan currency is under severe pressure. The value of Libya’s currency has already depreciated in the international market by more than 20 percent’’.

‘’Since 2011, Libya has been running a budget deficit except in 2012 when oil exports increased substantially. The recent drop in oil prices combined with limited oil exports is expected to widen the deficit even further in 2015’’.

‘’The World Bank estimates that at oil prices of $65 and with the current capacity of oil exports remaining at 400,000 b/d, the 2015 budget deficit would increase to 31 percent of GDP in 2015 from 11 percent in 2014. Financing the fiscal gap will be difficult as oil exports are not expected to recover any time soon’’.

‘’The lion’s share of Libya’s budget is apportioned to energy subsidies and civil servants’ wages. Salaries itself are a huge burden on the budget as a quarter of the Libyans are on the payroll and public sector wages have been increased by some 250 percent since the 2011 revolution’’.

‘’Foreign reserves and Libya’s currency would be under severe pressure unless there is a major policy change in terms of lowering the wage bill and huge energy subsidies’’.

‘’The Tripoli-based rival parliament has recently announced that it was considering lifting fuel subsidies which stand at 20 percent of GDP. If implemented, this could increase government saving and reduce the fiscal gap’’. [/restrict]