Tripoli, 6 February 2013:

“Economic growth in Libya is once again dipping into negative territory”, the World Bank reported in its latest MENA Quarterly Economic Brief.

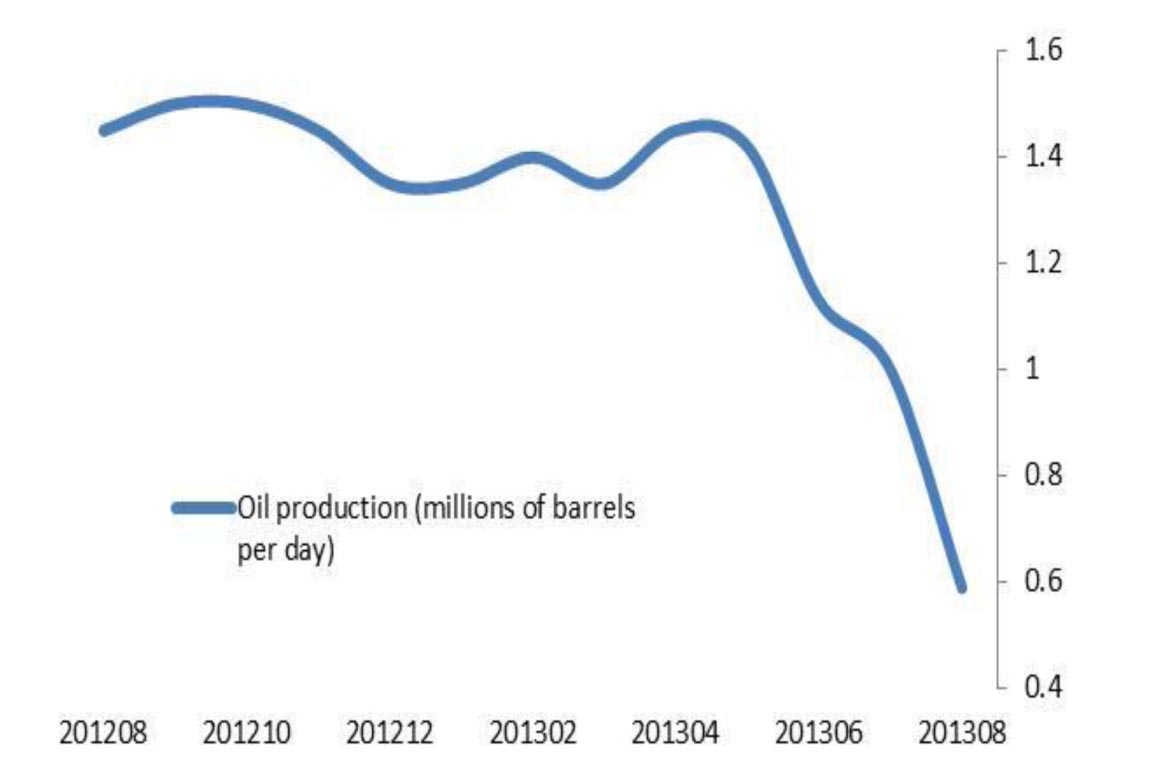

“After the sharp decrease of 62 percent in 2011, GDP rebounded sharply and growth reached 104 percent in 2012 as a result of massive oil production. But the recovery stalled in 2013 as the oil sector, the major contributor to growth and government revenue (accounting for about 70 percent of GDP and 95 percent of revenue) has been crippled by prolonged strikes at key oil terminals and loading ports since July, removing more than 1 million barrels per day (b/d) of crude oil production from exports”, it explained.

“Militia blockages of oil production and export facilities along with strikes by oil workers, tribesmen and other protesters at oilfields across the country, have cut oil production to 224,000 b/d in early December from more than 1.4 million b/d in June and 1.6 million during the pre-revolutionary period”, the report added.

The World Bank expressed its concern about the spending by the current government saying that “fiscal and current account balances have deteriorated sharply due to the oil blockade that has reduced oil revenue by 80 percent and also to continued expansionary fiscal policy”.

“In September 2013”, the report added, “the government announced a 20 percent increase in salaries for public-sector workers and issued a separate decision to raise the wages of Judicial Council staff”.

This double effect of reduced revenues and increased wages has led the World Bank to revise “its estimates for the fiscal stance of the government in 2013 and 2014. It is expected that the fiscal surplus of 2012 will turn into a deficit of about 5 percent of GDP for 2013 and 4 percent of GDP for 2014 respectively. The large current account surplus” that Libya had enjoyed for years “is also expected to fall sharply and reach near zero in 2013 and recover only slightly in 2014”, the World Bank concluded.

“Under the current situation, the government has had to dig deeper into its large stock of foreign reserves, which stood at $124 billion at end 2012, to finance its budget deficits in 2013 and 2014”, the report explained, adding that “between $10 and $13 billion have already been used in 2013”.

[/restrict]