Tripoli, March 16: Turkey’s Banking Regulation and Supervision Agency (BDDK) is handing back control of the Arab Turkish Bank (A&T Bank) . . .[restrict]to Libya.

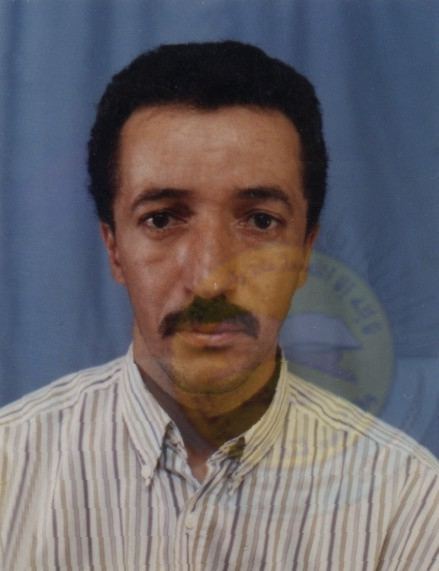

The Libyan Foreign Bank has a 62.37-percent stake in A&T Bank. BDDK handed over the running of the bank in July 2011 to Turkey’s Savings and Insurance Fund which appointed Osman Arslan as the bank’s general manager until March 15. He hand now been replaced by Sadek K.S. Abu Hallala.

A&T Bank was established in 1977 to provide trade financing between Turkish, North African and Middle Eastern businesses. It has 254 employees working at six Turkish branches. Profits in 2011 were 48.1 million Turkish Liras.

In January 2011, Turkey’s Economy Minister Zafer Ça?layan had said that A&T Bank would play a crucial role in Libya’s development. Ça?layan also predicted that the bank’s paid-in capital would increase from 240 million liras to 690 million liras, and that later it would be necessary to increase this number to one billion liras.

The return of Libyan assets seized in other countries after the UN imposed sanctions in February last year is picking up speed. Earlier this month, the central Bank of Uganda handed over control of the Tropical Bank, 99.7-percent owned by the Libyan Foreign Bank. In Gambia, the High Court ordered the return of a number of frozen assets belonging to the Libyan African Investment Company, including two hotels and an amusement park. [/restrict]