By Sami Zaptia.

London, 12 February 2016:

Four bank managers of various levels and positions at the Wahda bank Jama Saga branch in . . .[restrict]central Tripoli made video confessions in which they allegedly admitted to foreign currency exchange (FX) corruption.

The bank employees admitted to corruptly distributing their branch’s daily FX allocations received from the Central Bank of Libya (CBL) amongst employees at their branch, at Wahda bank headquarters and to the armed gangs that protect their branch.

They admitted that none of their daily US$ 60,000 FX allocations received were sold to any ordinary customers, as they are obliged to do.

One of the video confessors said that his branch manager took all of Thursday’s hard currency allocations for himself. Another confessor said that he operated the MoneyGram computer system at his branch.

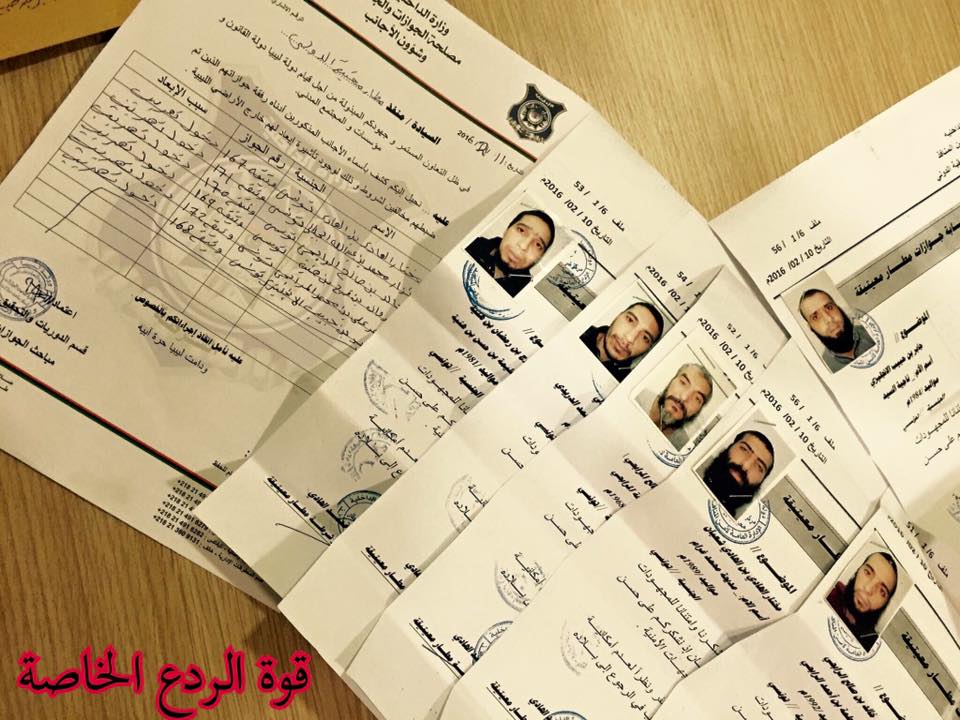

The videoed confessions by the bank employees were taken by the Abu Sleem unit of the General Administration of Central Security together with the Criminal Investigation Department of the Libyan Police.

They said that they took this action after receiving numerous complaints from frustrated members of the public who had knowledge that their local bank was receiving their daily FX allocations from the CBL, yet was not selling any to the general public.

The corrupt clamour for the hard to get foreign currency in Libya is both fuelled and the partial cause of the nearly three times black market exchange rate. At the official exchange rate one US$ costs around LD 1.30 whilst the black market rate is around 3.40 (quoted today).

The security authorities said that further investigations were ongoing and that further announcements and revelations will be made soon. All those arrested and accused of FX corruption are being referred to the Public Prosecutor’s Office, they added.

It will be recalled that CBL has come in for much public criticism since the February 2011 revolution in its role as the sole overseer of Libya’s banks and as the sole distributor of hard currency.

Some of the accusations are with regards to inefficiency and poor management by the CBL, intentional or unintentional and partly due to the weak state of Libya’s post-revolutionary institutions.

But there have also been accusations of political corruption with the CBL accused of willingly or unwillingly cooperating with the unrecognized rulers of Tripoli and their militias. There have been suspicions that the CBL as a result of having ‘’a gun held to its head’’ has turned a blind eye to many politically linked Letters of Credit and FX transfers and sales.

The CBL has always refuted these claims, reminding the public that it is a financial institution and not a law and order or criminal investigative body.

Moreover, together with the Audit Bureau, the CBL has launched a number of policy actions to counter. Many critics argue that this action was too little and too late after hundreds of millions or even billions have been corrupted away.

What is clear, and according to the CBL’s own periodic financial reports, Libya’s foreign currency reserves are fast depleting and expected to provide cover for the budget’s continuing deficit for a maximum of 2-3 more years.

This economic and financial crisis is compounded by the crash in Libya’s oil production rate from a peak of 1.5 barrels per day in 2012-13 to a current rate of about 400,000 bpd. This is coupled with the collapse in international crude oil prices from around US$ 100/b to under US$ 40/b.

With Libya importing over 80 percent of its consumer and food products, the near tripling of the FX rate has been reflected in everyday prices at the shops for the average Libyan citizen which has put extra pressure on all of Libya’s politicians of whichever camp and persuasion. [/restrict]